reverse tax calculator quebec

This marginal tax rate means that your immediate additional income will be taxed at this rate. That means that your net pay will be 36763 per year or 3064 per month.

Quebec Sales Tax Gst Qst Calculator 2022 Wowa Ca

In Quebec the provincial sales tax is called the Quebec Sales Tax QST and is set at 9975.

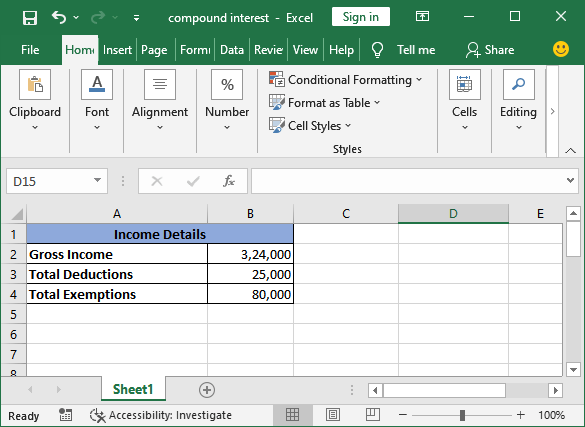

. CRA deferred GSTHST tax remittances and payments. Please enter your income deductions gains dividends and taxes paid to. How to use HST Calculator for reverse HST Calculation.

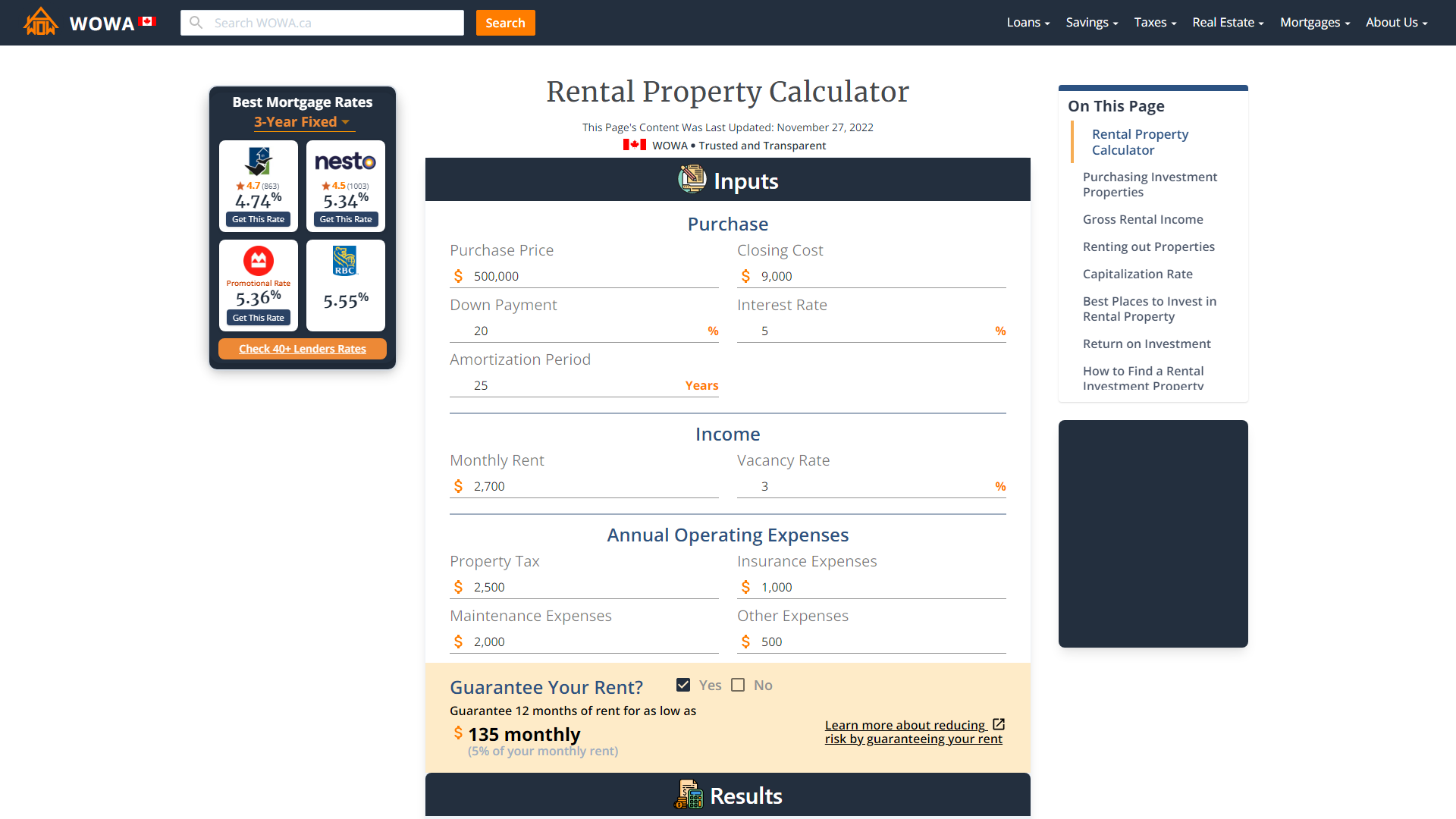

GSTQST Calculator Before Tax Amount. Use the Payroll Deductions Online Calculator PDOC to calculate federal provincial except for Quebec and territorial payroll deductions. Reverse Sales Tax Formula.

YEAR 2022 2021 2020 Net Salary Per Select one. Provinces and Territories with GST. Tax returns of individuals due date also deferred.

HST value and price without HST will be calculated automatically. 55 billion GST rebates to help who lost income due to COVID-19. It will confirm the deductions you include on your official statement of earnings.

Income Tax Calculator Quebec 2021. From there it is a simple subtraction problem to figure out that you paid 61 cents in sales tax. Montant sans taxes Taux TPS Montant de la TPS.

When was GST introduced in Canada. Relief measures for individuals and businesses by Revenu Québec. The TIP is at least equal to the sum of the taxes TPS TVQ is 15.

Alberta British Columbia BC Manitoba Northwest Territory Nunavut Quebec Saskatchewan Yukon GST Tax Rate. Ce chiffre correspond donc à 10 arrondissement de la TVQ 9975 du montant. If you make 52000 a year living in the region of Ontario Canada you will be taxed 11432.

Reverse GST Calculator. Get better visibility to your tax bracket marginal tax rate average tax rate payroll tax deductions tax refunds or taxes owed in 2022. Use our Income tax calculator to quickly estimate your federal and provincial taxes and your 2021 income tax refund.

It is easy to calculate GST inclusive and exclusive prices. Type of supply learn about what supplies are taxable or not. If youre looking for a reverse GST-only calculator the above is a great tool to use.

Calculator to calculate sales taxes in Quebec Beware some bars restaurants charge a tip on the amount TTC while it should be calculated on the amount HT. Vous devez donc le diviser mentalement par deux pour ainsi obtenir le. Where the supply is made learn about the place of supply rules.

The rate you will charge depends on different factors see. Your average tax rate is 293 and your marginal tax rate is 438. This calculator is for you.

Montant avec taxes Montant TPS et TVQ combiné 114975 Montant sans taxes. 2022 free Canada income tax calculator to quickly estimate your provincial taxes. The QST was consolidated in 1994 and was initially set at 65 growing over the years to the current amount of 9975 set in 2013.

What is GST rate in Canada. Your average tax rate is 220 and your marginal tax rate is 353. If your total receipt amount was 5798 and you paid 107 percent in sales tax youd simply plug those numbers into our calculator to find out that your original price before tax was 5737.

Tax Amount Original Cost - Original Cost 100 100 GST or HST or PST Amount without Tax Amount with Taxes - Tax Amount. This is any monetary amount you receive as salary wages commissions bonuses tips gratuities and honoraria payments given for professional services. If you make 52000 a year living in the region of Quebec Canada you will be taxed 15237.

Reverse HST Calculator Input. The guide contains information about how to make source deductions and how to remit and report source. WebRAS 2020 2021 and 2022.

WebRAS must be used with the Guide for Employers. You assume the risks associated with using this calculator. On the right sidebar there is list of calculators for all Canadian provinces where HST is introduced.

To calculate the subtotal amount and sales taxes from a total. Reverse GSTQST Calculator After Tax Amount. En utilisant le montant avant taxes déplacez la virgule ou le point dun chiffre vers la gauche.

To use the tool. Enter HST inclusive price on the bottom. Montant sans taxes Taux TVQ Montant de la TVQ.

Voici la façon dont est calculé le montant avant taxe. Source Deductions and Contributions TP-1015G-V. Province of Sale Select the province where the product buyer is located.

Who the supply is made to to learn about who may not pay the GSTHST. Reverse HST Calculator Result. That means that your net pay will be 40568 per year or 3381 per month.

This marginal tax rate means that your immediate additional income will be taxed at this rate. British Columbia Manitoba Québec and Saskatchewan. WebRAS is now the tool to use to calculate source deductions and employer contributions.

Ensure that the Find Subtotal before tax tab is selected. Calculates the canada reverse sales taxes HST GST and PST. The following table provides the GST and HST provincial rates since July 1 2010.

Need to start with an employees net after-tax pay and work your way back to gross pay. For provinces that split GST from PST such as Manitoba Quebec and Saskatchewan a No PST checkbox will appear. On January 01 1991 goods and services tax GST was introduced in Australia.

It can be used as well to reverse calculate Goods and Services tax calculator. Afin deffectuer un calcul mental simple de la TPS et TVQ vous pouvez utiliser cette méthode. 13 rows Harmonized Sales Tax HST The Harmonized Sales Tax or HST is a sales tax that is applied to.

In Québec it is. The reliability of the calculations produced depends on the. Only four Canadian provinces have PST Provincial Sales Tax.

The only thing to remember in our Reverse Sales. Calculate GST with this simple and quick Canadian GST calculator.

New Google User Interface Updates Refine Layers Mini Carousels Shopping Toggle Mortgage Calculator More Online Mortgage Mortgage Payment Calculator Mortgage Calculator

Quebec Sales Tax Calculator On The App Store

Canada Sales Tax Gst Hst Calculator Wowa Ca

![]()

Quebec Sales Tax Calculator On The App Store

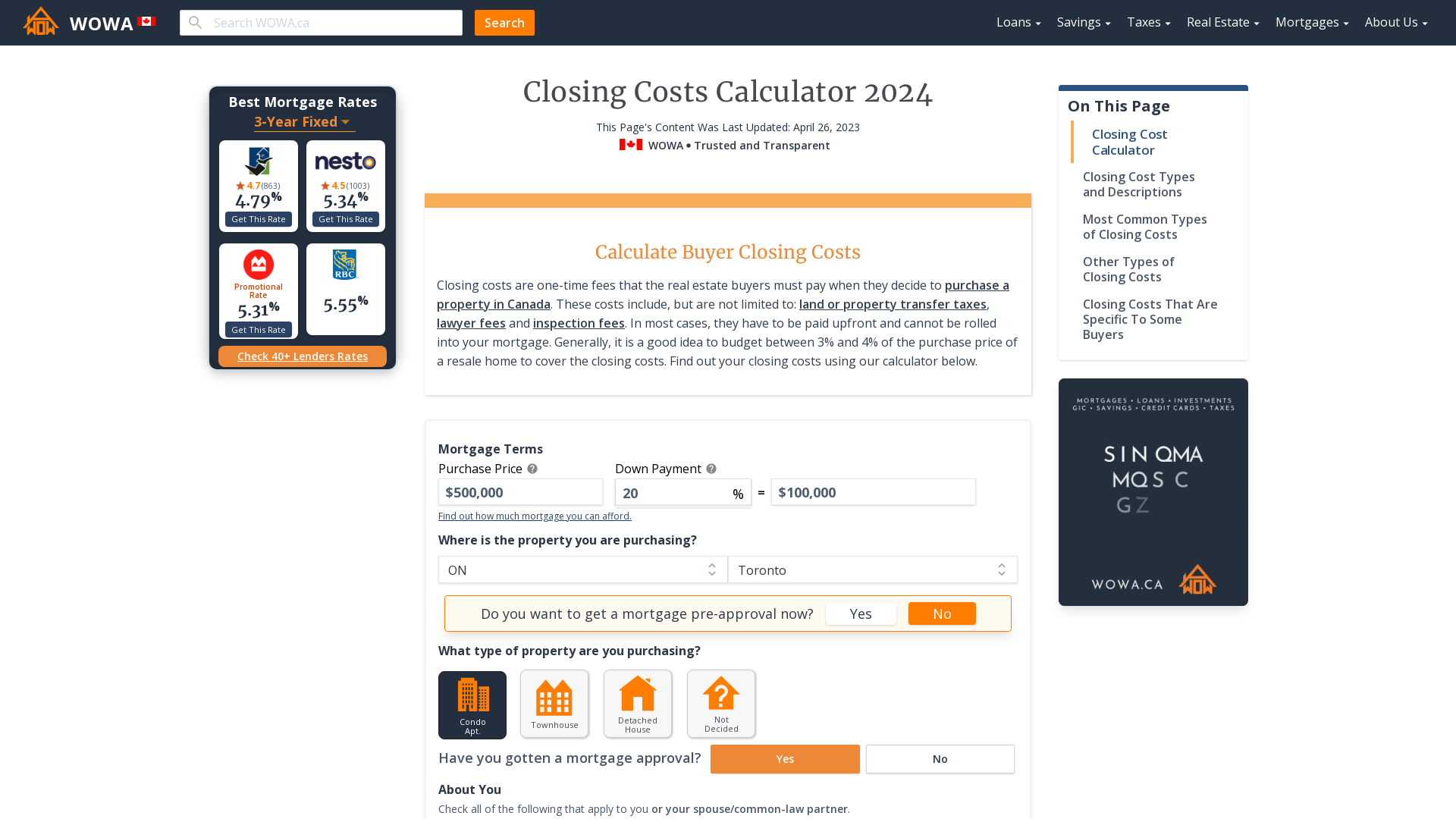

Home Closing Cost Calculator 2022 Wowa Ca

Payroll Calculator Canada Apps On Google Play

Reverse Sales Tax Calculator Gst And Qst Calendrier Live

Canada Sales Tax Calculator On The App Store

How To Calculate Sales Tax Methods Examples Video Lesson Transcript Study Com

3 Things We Wish We Had Done When We Had More Money Debt Management Mortgage Calculator Debt Management Plan

Reverse Gst Hst Pst Qst Calculator 2022 All Provinces In Canada

Quebec Tax Calculator Gst Qst Apps On Google Play

Sales Tax Decalculator Formula To Get Pre Tax Price From Total Price